Mutual Fund in Pakistan – How to Invest

What is Mutual Fund?

A mutual fund is a collection of money used by banks or other institutions to buy securities or conduct business. The term is typically used in Pakistan, the U.S., India, and Canada. The principal investment defines the name of a mutual fund: cash fund, index fund, stock or equity fund, and so on. There are also “actively monitored” funds. In other words, a manager actively monitors and trades on behalf of investors.

A mutual fund can be established as a trust or as an investment company. The Asset Management Company creates the trust (AMC). The trustee manages the trust’s assets on behalf of the trust’s unit holders. The mutual fund, on the other hand, is established as a publicly traded company under the investment company structure. The AMC, as the mutual fund’s sponsor, appoints a board of directors to manage its affairs, as well as a custodian to hold all of the investment company’s assets. The SECP licenses an AMC, which allows it to operate the mutual fund and manage its investments.

In Pakistan, people don’t know about any investment ideas. and there is a lack of knowledge among people about how to save and invest money. If you are interested in investing, you can find many options for investment on this blog. In this post, we are going to talk about mutual funds in Pakistan.

How mutual fund Works?

In a mutual fund, money gathered from numerous investors is pooled together to invest in a variety of securities, such as bonds, equities, and/or money market investments. The assets of mutual funds are professionally managed by fund managers, who work to maximize returns for investors.

Below is the video from Meezan Bank – very good illustration of Mutual Funds and how it works.

Types of Mutual Funds

Money Market Funds

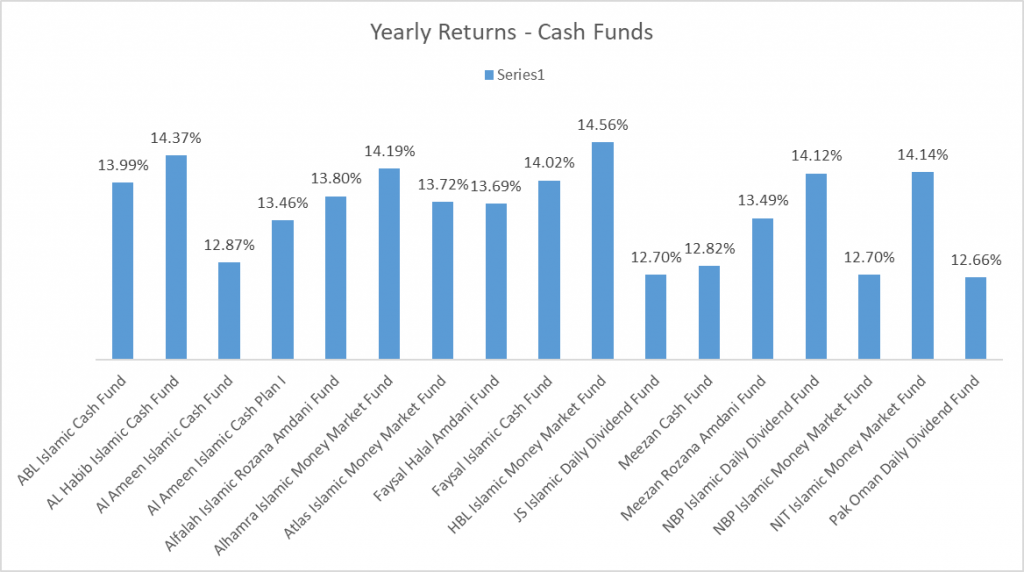

Money market funds are funds that invest in the money market. It is a fixed-income security with a very short time to maturity and high credit quality. Investors often use money market funds as cash in bank accounts. It gives a better return with low risk. The bank will profitably invest your money in short-term money market and debt securities. Some of Shariah Complaince Money Market funds in Pakistan [as of Feb 2023] are below

| Sr. | Fund Name | Validity Date | NAV | YTD |

| 1 | ABL Islamic Cash Fund | Feb 01, 2023 | 10 | 14.92% |

| 2 | AL Habib Islamic Cash Fund | Feb 01, 2023 | 100 | 14.77% |

| 3 | Al Ameen Islamic Cash Fund | Feb 01, 2023 | 109.164 | 13.93% |

| 4 | Al Ameen Islamic Cash Plan I | Feb 01, 2023 | 100 | 14.79% |

| 5 | Alfalah Islamic Rozana Amdani Fund | Feb 01, 2023 | 100 | 14.91% |

| 6 | Alhamra Islamic Money Market Fund | Feb 01, 2023 | 99.51 | 15.01% |

| 7 | Atlas Islamic Money Market Fund | Feb 01, 2023 | 500 | 14.52% |

| 8 | Faysal Halal Amdani Fund | Feb 01, 2023 | 101.434 | 15.07% |

| 9 | Faysal Islamic Cash Fund | Feb 01, 2023 | 100 | 15.43% |

| 10 | HBL Islamic Money Market Fund | Feb 01, 2023 | 101.174 | 15.25% |

| 11 | JS Islamic Daily Dividend Fund | Feb 01, 2023 | 100 | 14.78% |

| 12 | Meezan Cash Fund | Feb 01, 2023 | 50.9873 | 13.91% |

| 13 | Meezan Rozana Amdani Fund | Feb 01, 2023 | 50 | 14.80% |

| 14 | NBP Islamic Daily Dividend Fund | Feb 01, 2023 | 10 | 14.87% |

| 15 | NBP Islamic Money Market Fund | Feb 01, 2023 | 10.15 | 14.20% |

| 16 | NIT Islamic Money Market Fund | Feb 01, 2023 | 101.096 | 15.07% |

| 17 | Pak Oman Daily Dividend Fund | Feb 01, 2023 | 10 | 14.95% |

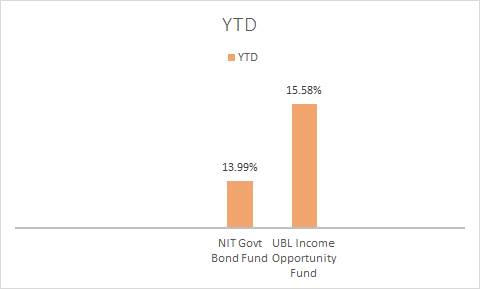

Bond Funds

These fund invest in fix income or debt securities. And Bonds are not shariah compliant; hence, they are not recommended. Bond funds can be sub-classified according to:

- The specific types of bonds owned (such as high-yield or junk bonds, investment-grade corporate bonds, government bonds or municipal bonds)

- The maturity of the bonds held (i.e., short-, intermediate- or long-term)

- The country of issuance of the bonds (such as the U.S., emerging market or global)

- The tax treatment of the interest received (taxable or tax-exempt)

Some of Bond Market funds in Pakistan [as of July 2022] are below

- NIT-Govt Bond Fund (NAV: 9.8814, Return: 13.99%)

- UBL Income Opportunity Fund (NAV: 111.09, Return 15.58%)

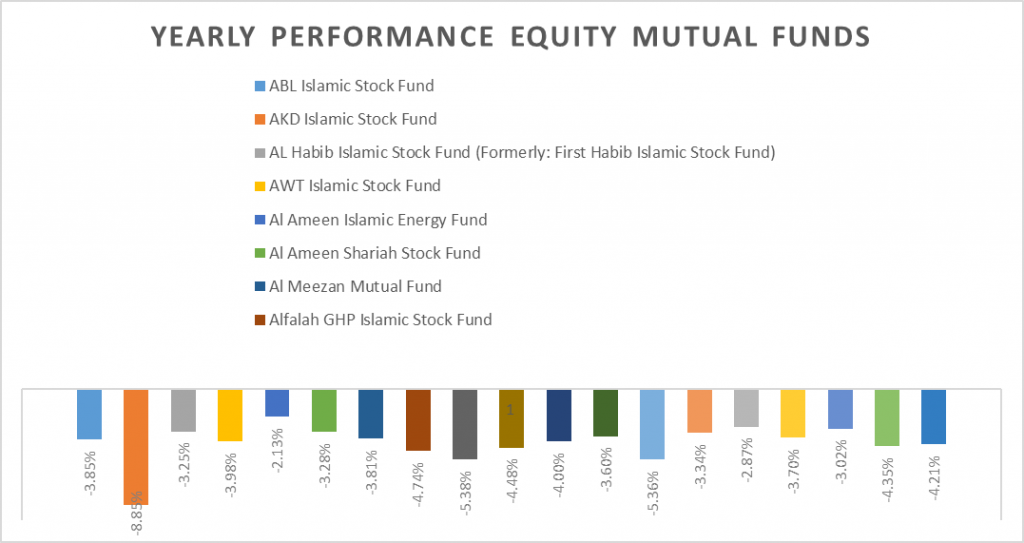

Stock or Equity Funds

These funds are invested in the stock market or equity market, and a manager is responsible for the sale and purchase of securities. It is a high risk fund but also provides high returns. and these funds closely follow the stock market. If the stock market falls, these funds will also fall. some of shariah compliance equity funds in Pakistan (as of july 2022) are as below

| Sr. No. | Fund Name | Validity Date | NAV | YTD |

| 1 | ABL Islamic Stock Fund | Jul 21, 2022 | 12.67 | -3.85% |

| 2 | AKD Islamic Stock Fund | Jul 21, 2022 | 36.89 | -8.85% |

| 3 | AL Habib Islamic Stock Fund (Formerly: First Habib Islamic Stock Fund) | Jul 21, 2022 | 72.09 | -3.25% |

| 4 | AWT Islamic Stock Fund | Jul 21, 2022 | 77.91 | -3.98% |

| 5 | Al Ameen Islamic Energy Fund | Jul 21, 2022 | 85.20 | -2.13% |

| 6 | Al Ameen Shariah Stock Fund | Jul 21, 2022 | 135.48 | -3.28% |

| 7 | Al Meezan Mutual Fund | Jul 21, 2022 | 15.12 | -3.81% |

| 8 | Alfalah GHP Islamic Stock Fund | Jul 21, 2022 | 35.16 | -4.74% |

| 9 | Alhamra Islamic Stock Fund | Jul 21, 2022 | 8.61 | -5.38% |

| 10 | Atlas Islamic Stock Fund | Jul 21, 2022 | 472.26 | -4.48% |

| 11 | Faysal Islamic Stock Fund | Jul 21, 2022 | 101.14 | -4.00% |

| 12 | HBL Islamic Equity Fund | Jul 22, 2022 | 67.46 | -3.60% |

| 13 | HBL Islamic Stock Fund | Jul 21, 2022 | 83.69 | -5.36% |

| 14 | JS Islamic Fund | Jul 21, 2022 | 81.62 | -3.34% |

| 15 | Meezan Energy Fund | Jul 21, 2022 | 30.62 | -2.87% |

| 16 | Meezan Islamic Fund | Jul 21, 2022 | 54.15 | -3.70% |

| 17 | NBP Islamic Energy Fund | Jul 21, 2022 | 8.56 | -3.02% |

| 18 | NBP Islamic Stock Fund | Jul 21, 2022 | 10.14 | -4.35% |

| 19 | NIT Islamic Equity Fund | Jul 21, 2022 | 7.06 | -4.21% |

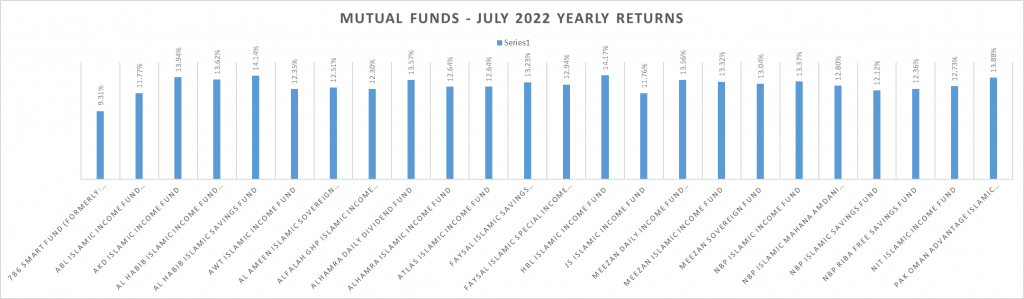

Other Funds

Funds may invest in Comodities or businesses. some of shariah compliance Income funds in Pakistan (as of July 2022) as below

| Sr. No | Fund Name | Validity Date | NAV | YTD |

| 1 | 786 Smart Fund (Formerly: Dawood Income Fund) | Jul 21, 2022 | 82.15 | 9.31% |

| 2 | ABL Islamic Income Fund (Formerly: ABL Islamic Cash Fund) | Jul 21, 2022 | 10.31 | 11.77% |

| 3 | AKD Islamic Income Fund | Jul 21, 2022 | 51.00 | 13.94% |

| 4 | AL Habib Islamic Income Fund (Formerly: First Habib Islamic Income Fund) | Jul 21, 2022 | 101.49 | 13.62% |

| 5 | AL Habib Islamic Savings Fund | Jul 22, 2022 | 100.00 | 14.14% |

| 6 | AWT Islamic Income Fund | Jul 21, 2022 | 105.56 | 12.35% |

| 7 | Al Ameen Islamic Sovereign Fund | Jul 21, 2022 | 102.21 | 12.51% |

| 8 | Alfalah GHP Islamic Income Fund | Jul 21, 2022 | 103.12 | 12.30% |

| 9 | Alhamra Daily Dividend Fund | Jul 22, 2022 | 100.00 | 13.57% |

| 10 | Alhamra Islamic Income Fund | Jul 21, 2022 | 102.91 | 12.64% |

| 11 | Atlas Islamic Income Fund | Jul 21, 2022 | 510.74 | 12.64% |

| 12 | Faysal Islamic Savings Growth Fund | Jul 21, 2022 | 104.61 | 13.23% |

| 13 | Faysal Islamic Special Income Plan I | Jul 21, 2022 | 100.76 | 12.94% |

| 14 | HBL Islamic Income Fund | Jul 21, 2022 | 103.60 | 14.17% |

| 15 | JS Islamic Income Fund | Jul 21, 2022 | 105.47 | 11.76% |

| 16 | Meezan Daily Income Fund (MDIP I) | Jul 21, 2022 | 50.00 | 13.56% |

| 17 | Meezan Islamic Income Fund | Jul 21, 2022 | 51.93 | 13.32% |

| 18 | Meezan Sovereign Fund | Jul 21, 2022 | 52.05 | 13.04% |

| 19 | NBP Islamic Income Fund | Jul 21, 2022 | 10.12 | 13.37% |

| 20 | NBP Islamic Mahana Amdani Fund | Jul 21, 2022 | 10.13 | 12.80% |

| 21 | NBP Islamic Savings Fund | Jul 22, 2022 | 9.62 | 12.12% |

| 22 | NBP Riba Free Savings Fund | Jul 21, 2022 | 10.34 | 12.36% |

| 23 | NIT Islamic Income Fund | Jul 21, 2022 | 9.49 | 12.73% |

| 24 | Pak Oman Advantage Islamic Income Fund | Jul 21, 2022 | 53.23 | 13.88% |

You can find complete List of Mutual Funds and their performance here

What Mutual Funds to invest in?

First, think about your financial goals and select a fund accordingly. For example, do you want your financial resources to develop steadily and without risk over time? Do you desire the greatest possible returns? These questions need original solutions.

Check the list below to select the best mutual fund

- Check the type of Mutual Fund, if it is active and passive mutual fund. How much risk it contains

- Check its past performance and evaluate the future performance of the fund

- Consider the Mutual fund fee whil selecting the fund. it is one of the most important trait

- Below is some questions list you need to ask from Fund Manager

- How has this fund performed over time? what are it’s returns

- What is the risk profile of this fund?

- What is the rating of this fund in MUFAP comparisons for similar funds

- What are the investment ventures of this funds? if it invest in stocks then what type of stocks it invests in

- How often does the portfolio updated?

- What is the fee structure of fund for both purchase and selling units

You should only invest if you are happy with the answers. Before transferring your funds, you should review the offering documents, fund manager’s report, and fund performance on the MUFAP website. Returns are provided for various fund categories for the month, year, and 365 days.

Documents Required for Mutual Fund account Opening

Contact the AMCs or their designated vendors for an application form, or visit their website. When you open an account, you must provide the following information:

- Copy of CNIC Application

- Account Opening Form

- Zakat Affidavit (Optional)

- FATCA Form/KYC Form

- Draft Cheque: Payable to the respective trustee by check/pay order/demand draft (make sure to write cheque only in the favor of the respective trustee)

Data given above will help you to select the best mutual fund for you. Happy Investing

Usefull to know the current investment opportunities

Pingback: ETF - Exchange Traded Funds - booksbaracket

Pingback: Cryptocurrency for Beginners - booksbaracket

Pingback: ETF - Exchange Traded Funds - booksbaracket

Pingback: ABL-ISF: A Great Profit Investment in Stock Mutual Fund - booksbaracket

Pingback: AKD-ISF - Best Mutual Fund to Invest in Pakistan - booksbaracket

Pingback: 7 Best Halal Investment Opportunities in Pakistan - booksbaracket